Pets sometimes outlive their owners. A client’s accident or illness can leave their pet without a caregiver, which, without the proper planning, can result in the pet being sent to an animal rescue or shelter. Compiling a list of common expenses is the first step in protecting a beloved pet’s future. You can assist your […]

Continue reading…Options for Your Client’s Pet Caregiver

If your client has a severe illness or accident or passes away, who will look after their pet? There are many ways to ensure that a client’s pet continues to have a loving home, and the process begins with finding the right caregiver. Guardian of Their Minor Children If your clients also have minor children, […]

Continue reading…How Clients Can Show Their Four-Legged Pals Some Love

Help Your Clients Provide Financial Support for Their Pet in Uncertain Times As of 2023, 66 percent of US households own a pet. A Forbes Advisor survey of more than 5,000 dog owners found that 41 percent of dog owners spend between $500 and $1,999 a year on their dogs and 8 percent spend more […]

Continue reading…

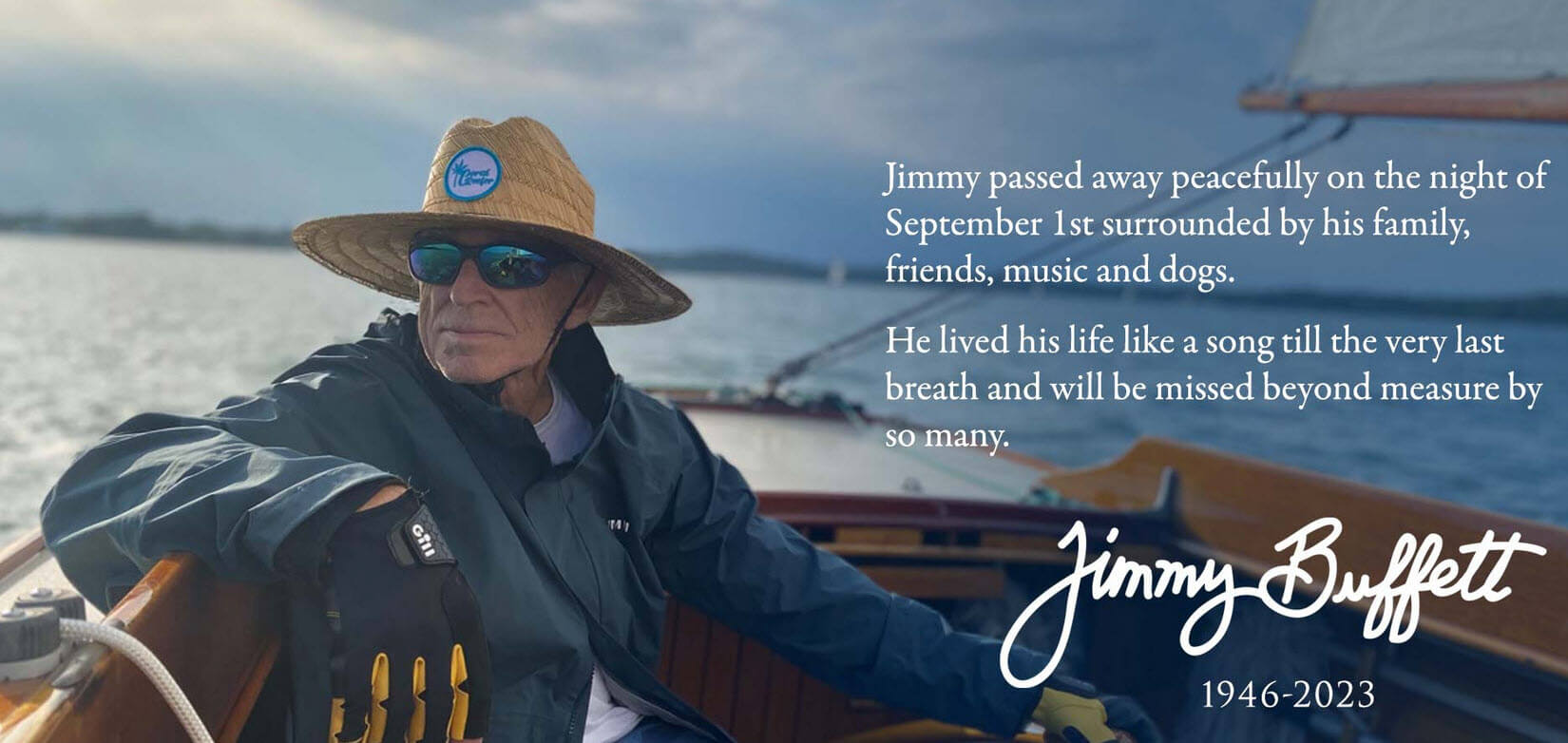

The Life and Legacy of Jimmy Buffett

Jimmy Buffett died on September 1, 2023, at age 76 after a diagnosis of Merkel cell carcinoma (skin cancer) four years earlier. He was a renowned singer-songwriter, film producer, businessman, novelist, and philanthropist. Buffett released his first album, Down to Earth, in 1970. By 2023, his net worth was officially $1 billion,1 including a $180 million stake […]

Continue reading…

Estate Planning for Expatriates

The United States hosts the highest number of immigrants in the world, but increasingly, Americans say they are looking to relocate permanently to another country. A large percentage of wealthy Americans are also interested in buying real estate overseas and living there at least part-time. While moving overseas is often a lifestyle decision, the practical […]

Continue reading…

What Happens to My Leased Car If I Die Before the Lease Term Ends?

After a house, a car is often the second-most valuable piece of property a person owns. About 15–20 percent of new vehicles are leased rather than purchased and financed. Leasing is a popular alternative to traditional financing because it can allow the lessee (the person who leases a vehicle) to drive a more expensive car […]

Continue reading…

How Far in Advance Can I Begin My Estate Planning?

You can create your estate plan at any time, but many people choose to begin the process sooner rather than later. Why? Because you never know when life-changing medical or financial emergencies can strike that will require someone else to manage your affairs during your lifetime. When Should You Start? When to start planning for […]

Continue reading…An Estate Plan Is a Great Way for Clients to Give Thanks

Your Clients’ Legacies: How Do They Want to Be Remembered? As trusted advisors, we often discuss with our clients all aspects of the future, whether it be their financial future, the future support of their loved ones, or what the future will look like when they are no longer a part of it. Epitaph Day […]

Continue reading…Give Thanks This Year with an Up-to-Date Estate Plan

Your Legacy: How Do You Want to Be Remembered? As Thomas Campbell, physicist and the author of My Big TOE, once said, “To live in the hearts we leave behind is not to die.” When we lose a loved one, we often have memories of special events and occasions, support they provided us, or specific […]

Continue reading…

What Do I Do If I Want to Undo My Revoked Will?

When life circumstances change, you may alter the decisions you have made in your estate planning documents. You might choose to revoke your will at some point. But what if you have a change of heart and want to reinstate it? There are different ways to revive a revoked will. Reviving Your Old Will Depending […]

Continue reading…