Sitting down to create or update your estate plan can be overwhelming. Crucial to a successful plan is your ability to address two major questions: Who will get your stuff when you die, and how do you want those individuals or charities to receive that stuff?

Ways to Give Away Your Money and Property

Outright

One way you can give away your money and property at your death is to give it outright. In other words, once you have passed away and the administration process has been completed, your beneficiary will receive their inheritance (e.g., a bank or investment account, real property, etc.) outright with no strings attached. The inheritance immediately becomes theirs to do with as they please. This provides your beneficiary with the maximum amount of freedom and flexibility. They can keep the account or property, or they could spend or liquidate it. Additionally, this type of distribution is easy to include in your estate plan and easy to administer after your passing. All you need to do when preparing your estate plan is name the beneficiaries you want to receive your stuff in your trust or will. You do not have to plan out or have your attorney draft long and customized distribution provisions.

When it is time to distribute your money and property after your death, your accounts or properties will be turned over to your chosen beneficiaries after your debts have been settled, any applicable taxes have been paid, and your affairs have been wound down. However, please know that this freedom and ease come at a cost. If your beneficiary has creditor issues, is in the middle of a divorce, or is not good at managing their money at the time the distributions are to be made, that inheritance could be gone quickly. Further, you will almost never want minor children or beneficiaries with special needs to receive their inheritance outright.

In Trust

Regardless of whether you chose a will or revocable living trust as the tool for distributing your money and property at your death, that document can include a provision holding your beneficiary’s inheritance in a separate trust for their benefit. Having a beneficiary’s inheritance held in a trust means that your beneficiary will not receive their inheritance outright but will instead receive their inheritance when the terms and conditions that you create are satisfied. Here are some examples of terms and conditions for an inheritance that you may choose to establish for your beneficiaries:

- As a specified sum or percentage of the trust share when the beneficiary has reached certain ages (for example, one-third of the trust at age 30, one-half of the remaining trust at 35, and the remainder at 40). Under this scenario, your beneficiary will slowly have access to their inheritance. If the beneficiary makes bad choices with their inheritance in the beginning, they have time to learn from those experiences before being given additional distributions.

- As a specified sum or percentage upon reaching certain milestones (for example, one-third of the trust upon earning a postsecondary degree, trade school certificate, or honorable discharge from the military; one-half of the remaining trust upon successfully acquiring and maintaining employment for five years; and the remaining amount in the trust upon retirement). This option allows you to include certain milestones that you want your beneficiary to achieve before they receive their inheritance. If your beneficiary does not achieve the first one, they will have an opportunity to get access to their inheritance by completing other milestones. This option allows you to share your values with your loved ones. However, it may also cause difficulties if your beneficiaries do not meet one or more milestones or if the beneficiaries need access to the inheritance for reasonable purposes before hitting the milestones.

- For specific events or purchases (for example, an amount equal to the average cost of a wedding in your geographic area, the average cost of a three-bedroom home in your geographic area, or 50 percent of the start-up capital necessary to form a business once a business plan has been submitted and approved by the trustee). These provisions allow you to tailor the inheritance to fund those events or experiences that you believe are important and that you want to support. You can implement these distribution terms alongside many of the other scenarios described here.

- At the trustee’s discretion. Creating a fully discretionary trust means that your beneficiary will receive money from their trust share only if the trustee believes it is in the best interest of the beneficiary to receive funds. While this distribution scheme may seem very restrictive, it allows a trustee to evaluate the beneficiary’s situation at the time a request is made and adapt to changing needs. Also, by not entitling beneficiaries to inheritance distributions, any money or property held in the beneficiary’s trust has a greater chance of being unreachable by creditors or divorcing spouses. Once the money or property is given to the beneficiary, it can be taken. This allows the trustee to protect the legacy you are leaving behind.

- In a special or supplemental needs trust. For individuals who receive or may receive government benefits due to a disability, the structure of their inheritance is very important. It may be necessary to leave an inheritance to these individuals in a special type of trust that does not disqualify them from receiving the government benefits while also allowing them to receive some benefit from the inheritance. Failing to properly structure the trust could cost your loved one their government benefits.

The important thing to remember is that you need to proactively make a legally valid plan if you have specific wishes about how your loved one will receive their inheritance. Without a plan put in place by you, your loved ones will be stuck with following the state law that determines who receives what, how much they receive, and how they receive it. For example, most state statutes will give an inheritance to an adult outright. So if you want more restrictions on your loved one’s inheritance, you need to have an estate plan that reflects your wishes. However, it is important to note that including a trust in your estate plan may lead to additional administrative tasks that may not otherwise arise, such as filing income tax returns for the trust, investing and managing trust assets, and preparing inventories and accountings. These tasks take time, and the person carrying out these tasks (the trustee) can charge the trust for their time.

Deciding Which Method to Use

Depending on who your beneficiary is, some options might be a better fit than others. It is important that you understand who your beneficiary is, what their needs are, and what your desired outcome is.

Charity

If you want to leave money or property to a charity, you may choose to give the money or property outright, especially if there is a particular goal or defined purpose that you have for the gift. You may also consider leaving the gift outright if you want it used for general charitable purposes, which in many cases, is what a charity would prefer when designating the use of the gift. However, you may choose to incorporate a charitable trust as part of your estate plan. This might be desirable if you have certain tax objectives that you want to accomplish.

Minor Child or Other Minor Loved One

It is usually advisable to leave an inheritance for minor children in trust for their benefit because, in most cases, a minor cannot legally own or manage their own accounts or property. With a trust, you can determine who will manage the inheritance instead of having a judge choose a guardian or conservator to manage the minor’s inheritance. If the money or property is left outright to the minor, it will likely be held for their benefit by a guardian, conservator, or custodian until the minor reaches the age of majority (18 or 21, depending on the state). This means that when the beneficiary becomes an adult, their inheritance will be distributed outright to them without any restrictions. For someone still so young, this could be risky.

Adult Child or Other Adult Loved One

Depending on the adult’s situation and the value of the inheritance you would like to leave them, all of the options described above could be available to you. However, when weighing the available options, there are some important considerations:

- Is your loved one likely to spend their inheritance as soon as they get it?

- Is there a likely possibility that your loved one may get divorced?

- Is your loved one engaged in a high-risk profession (e.g., law, medicine, etc.)?

- Is your loved one receiving or likely to receive government benefits?

If you answered yes to any of the above questions, you may not want to leave an inheritance to your loved one outright. A trust with specific terms, tailored to your beneficiary’s unique situation, may be the best way to ensure that the inheritance benefits your loved one instead of causing problems for them.

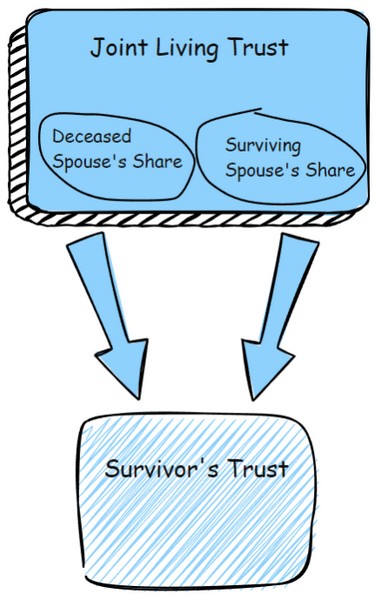

Surviving Spouse

If you are married, you may want everything you have to go outright to your surviving spouse upon your death. Maybe you consider everything you own to be owned jointly with your spouse, you want things to run as smoothly as possible, or you want your spouse properly provided for when you pass away. In addition to the considerations that we discussed for other adult loved ones, you need to consider the likelihood that your spouse may remarry or enter into another close relationship with someone and if that affects your decision in any way. If you leave everything outright to your surviving spouse, they will have the freedom to use the money and property in any way they want, including leaving it to a new spouse or buying expensive gifts for a new partner. If this is not what you want done with your money and property, it is important that you have a plan in place that puts more restrictions on your spouse’s inheritance.

We Are Here to Help

We know that there are a lot of different factors to consider when leaving an inheritance to your loved ones. We are here to walk you through the different options and help you solidify a plan that honors your wishes and protects your loved ones. If you need to begin the estate planning process or review your existing estate plan, please give our office a call.