When developing your estate plan, it is nearly impossible to address every account or property you own. There are sure to be some things you unintentionally overlook. However, by including a residuary clause, you can intentionally disburse any remaining items inadvertently left over during the estate or trust administration process to a named beneficiary or […]

Continue reading…

Saying Goodbye Is Hard: How a Comprehensive Estate Plan Can Help

When people think about estate planning, they usually focus on who will receive their money and property when they pass away and how it will be received. However, estate planning can also address your end-of-life wishes—the considerations and expenses involved when it is time to say goodbye to your loved ones. The following are important […]

Continue reading…

What Is the Difference Between a Probate and Trust Administration Attorney and an Estate Planning Attorney?

Estate planning attorneys and probate and trust administration attorneys play crucial but distinct roles in the legal processes involving legacy planning, asset distribution, and wealth preservation. Estate planning attorneys focus on creating a plan to manage a person’s money, property, and affairs upon their death or if they are unable to manage it themselves. Probate […]

Continue reading…

What Happens to Real Estate With a Mortgage When I Die?

Your mortgage, like the rest of your debt, does not simply disappear when you die. If you leave your home that has an outstanding loan to a beneficiary in your will or trust, your beneficiary will inherit not only the property but also the outstanding debt. They may have the right to take over the […]

Continue reading…Generational Wealth through Adoption and Dynasty Trusts

Since a dynasty trust is mainly used to create a lasting financial legacy for multiple generations, it is structured to provide for the client’s descendants. This is a common strategy to ensure that wealth is preserved and passed down over many lifetimes and stays within the bloodline. However, if a beneficiary does not have any […]

Continue reading…Successful Dynasty Trusts in History: The Rockefeller Family

Dynasty trusts have played a crucial role in preserving wealth and fostering a lasting financial legacy for many affluent families throughout history. One excellent example is the Rockefeller family, whose strategic use of dynasty trusts has made them one of the most prosperous and enduring family dynasties in the world. Who Started It? The Rockefeller […]

Continue reading…

Inspiring Action: The Guide to Creating or Updating Your Estate Plan

Creating or revising an estate plan can feel overwhelming, causing many people to procrastinate. But the longer you put it off, the more potential there is to be caught unprepared in an emergency. So how can you motivate yourself and your loved ones to begin the process? Here are some strategies to help you overcome […]

Continue reading…

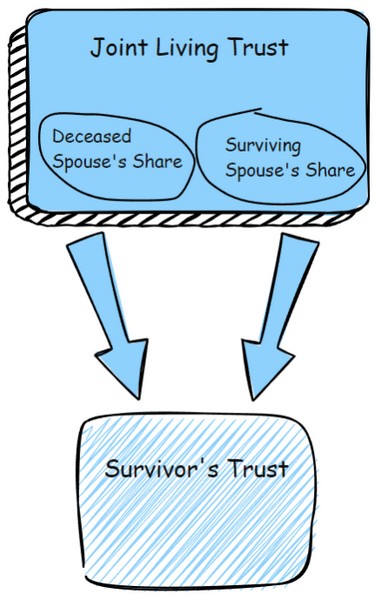

I’m a Survivor . . . and Now I Have My Own Trust?

Many married couples share almost everything, including finances. This may be reflected in their estate plan by using one joint living trust instead of two separate trusts. Separate trusts can provide greater flexibility, but a joint trust can be structured so that when one spouse passes away, the trust is split into two subtrusts: a […]

Continue reading…Creating and Preserving Your Legacy with a Dynasty Trust

What Is a Dynasty Trust and Why Should You Consider One? If you have significant wealth, one of the best ways to protect your family and transfer your wealth is through a dynasty trust. However, setting one up requires considerable financial and estate planning knowledge. As experienced estate planning attorneys, we can explore all options […]

Continue reading…Preserving Your Client’s Legacy with a Dynasty Trust

What Is a Dynasty Trust and Which Clients Should Consider Them? Advising your clients on the best ways to protect their family and wealth requires considerable financial and estate planning knowledge. Armed with this knowledge, you can help your clients explore all options available to protect their legacy. Depending on a client’s situation, a dynasty […]

Continue reading…