Your family member went through a meticulous estate planning process to organize and distribute money and property for the benefit of their loved ones, including you. But you may suspect that some of the high-value items in their estate originated as stolen property. The possibility of discovering stolen items within an estate is often overlooked, but it can have legal, financial, and emotional complications. How does it happen?

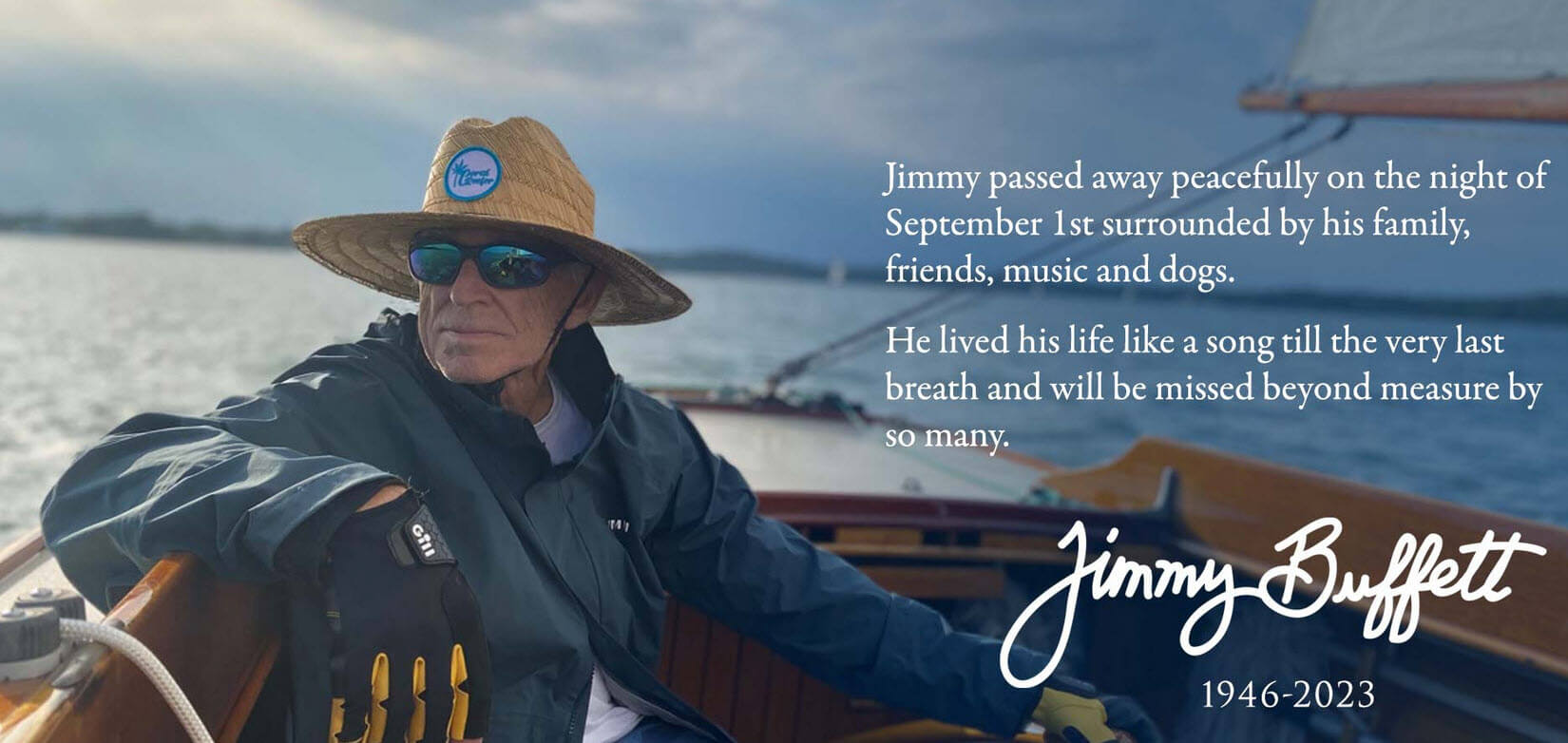

Example: Stolen Artwork

A New York Times article published in 2023 reported that the New York Metropolitan Museum is carefully combing through its art collections after the government seized dozens of art pieces that were suspected of having been stolen or looted in the past. It is widely known that art collections have mysteriously disappeared over the centuries, especially during wartime, and that ownership should be researched to avoid purchasing an item that belongs to someone else. The Art Loss Register alone lists 700,000 stolen items. Many items find their way into legitimate markets through underground dealers where criminals can exploit innocent buyers.

When putting together your estate plan, any significant collections you own should be taken into consideration. If your loved one receives stolen items from you at your death, they may not receive legal title to the item, exposing the estate to financial and tax implications. If artwork or other high-value property is removed from the estate, it can affect the liquidity necessary to meet potential estate tax and administrative costs as well as the inheritance of beneficiaries. An estate planning attorney can prepare for different scenarios to protect you and your family.

Private Letter Rulings and Seized Assets

According to a private letter ruling, if your family discovers stolen items after a loved one’s death, the Internal Revenue Service could include the fair market value of the property in the deceased’s estate for estate tax purposes, even after it has been seized and returned to the owner. This could leave the family owing an estate tax but unable to sell the item in order to pay the estate tax.

The government can seize property it believes has been involved in illicit or criminal activity. Even if your family member purchased an item from a reputable dealer or inherited the item decades ago, it can still be taken.

How People Come into Possession of Stolen Items

Understanding how individuals unknowingly acquire stolen items is crucial for recognizing potential risks. Innocent parties often purchase items through estate sales or auctions or receive gifts from friends or family members. A lack of transparent ownership or a historical record can make it challenging for the unsuspecting owner to identify stolen items.

Every year, over one million homes are burglarized and almost one hundred billion in store merchandise is stolen. Billions in stolen property is circulating, leaving innocent buyers liable. Those possessing stolen items can serve time in jail or be forced to pay a fine.

Common places to come across stolen goods are online marketplaces such as Craigslist, eBay, or Facebook Marketplace that have lax regulations for selling items. Pawn shops can often be unsure of the origins of their inventory, but they are required to research ownership or face prosecution.

Can You Be Held Accountable?

Not everyone is held accountable for being in possession of stolen goods. There is no statute of limitations for prior owners to claim their stolen property, but there are legal defenses used for possessing it. The defense of laches asserts that prior owners who unreasonably delayed asserting their rights may not be entitled to bring a claim against the person or estate in possession of their property. After all, the property may have already been sold and the proceeds divided among heirs, making it very difficult to recover.

Whether you can be prosecuted or convicted of possessing stolen property depends on several factors:

- Knowledge that the item was stolen. Suspected stolen items should be reported to law enforcement, or you could be held accountable. However, if it was nearly impossible to know it was stolen, you will likely not be held accountable.

- Knowledge that the item was in your possession. You can unknowingly be in possession of a stolen item. If you are honest, open, and prompt, you should not be held accountable.

What Should You Do If You Suspect Ownership of Stolen Property?

You can take steps during your family member’s lifetime to address your suspicions. Be proactive. If there is a hint of uncertainty about the legitimacy of an item, your estate planning attorney can take the following steps:

- Research the item’s history and provenance to trace its ownership back to its origin to see whether it has ever been reported as stolen.

- Seek guidance from professionals such as art historians, appraisers, or legal experts who specialize in stolen art and property. They can validate legitimate ownership.

- Report the situation to law enforcement in a timely manner to contribute to the recovery of stolen property and prevent legal complications down the line.

There is a risk of discovering stolen items within a loved one’s estate, especially with high-value collections. Do not overlook this when doing your estate planning. By being vigilant, understanding the legal implications, and taking proactive steps, you can mitigate the risks of inheriting or owning stolen property and ensure a smoother estate settlement process for you or your loved ones. Contact our estate planning attorney today.

A Proper Estate Plan Can Protect You and Your Family

Proper estate planning can protect you from the risks of owning stolen property through due diligence and research, ensuring that the prior owner’s rights are extinguished. Unfortunately, research into the origins of property can be expensive, often costing more than the item’s value. However, where there is one suspicious item, there may be more.

If you are the beneficiary of gifts with suspicious origins, you can disclaim them. If you have questions about something in your collection or your recent inheritance, you can contact our office.